extended child tax credit dates

The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion. If you received advance.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Unless Congress takes action the 2020 tax credit rules apply in 2022.

. The maximum child tax credit amount will decrease in 2022 In 2021. Families could be eligible to. Govt made an amendment to CGST and services tax Act to give more time to businesses for claiming input tax credit issuing credit notes and removing errors by extending.

But if Bidens nearly 2 trillion American Families Plan ever gets. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible taxpayers. The cost of extending it until 2025 has been. Date of Payment Details.

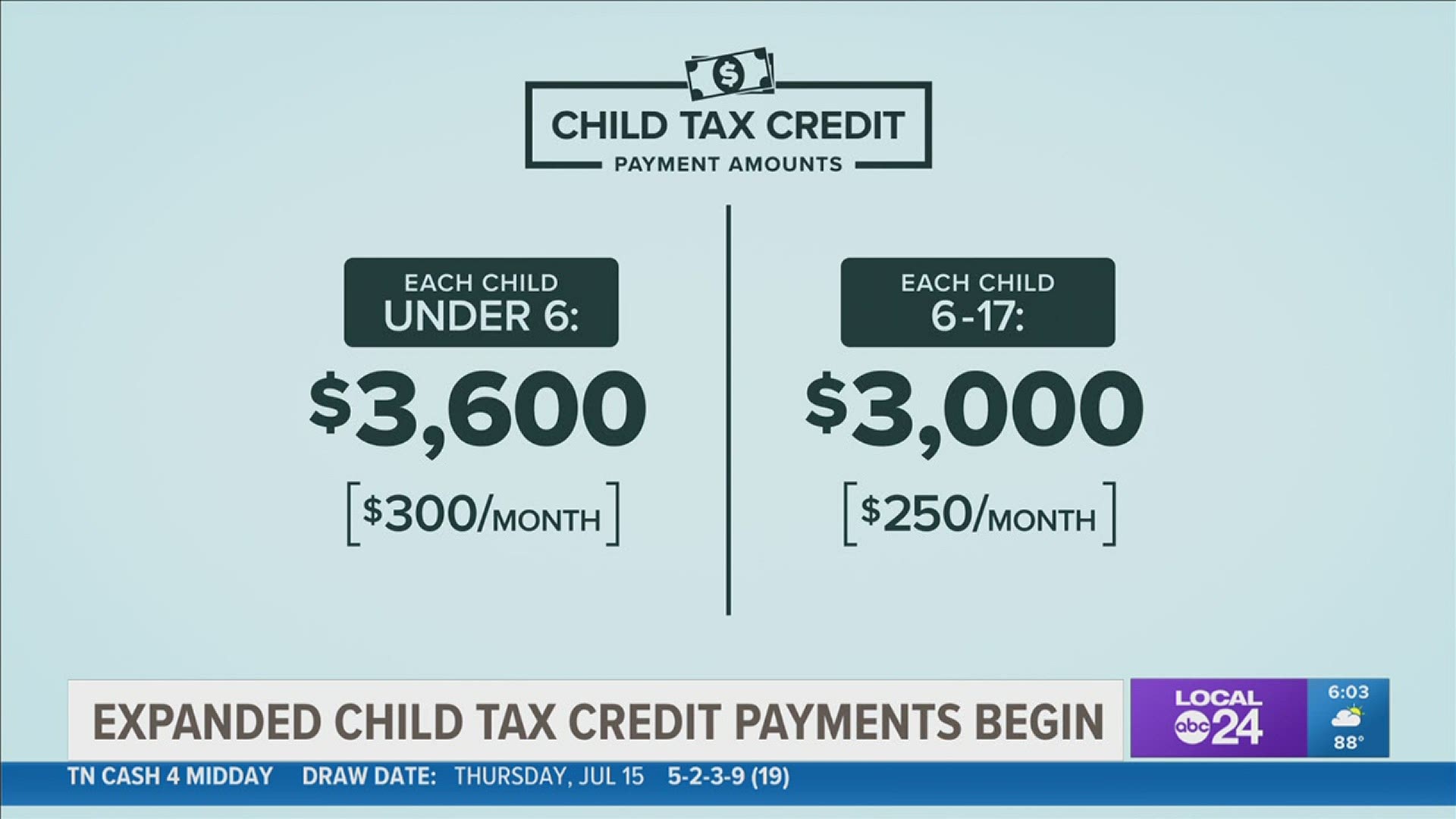

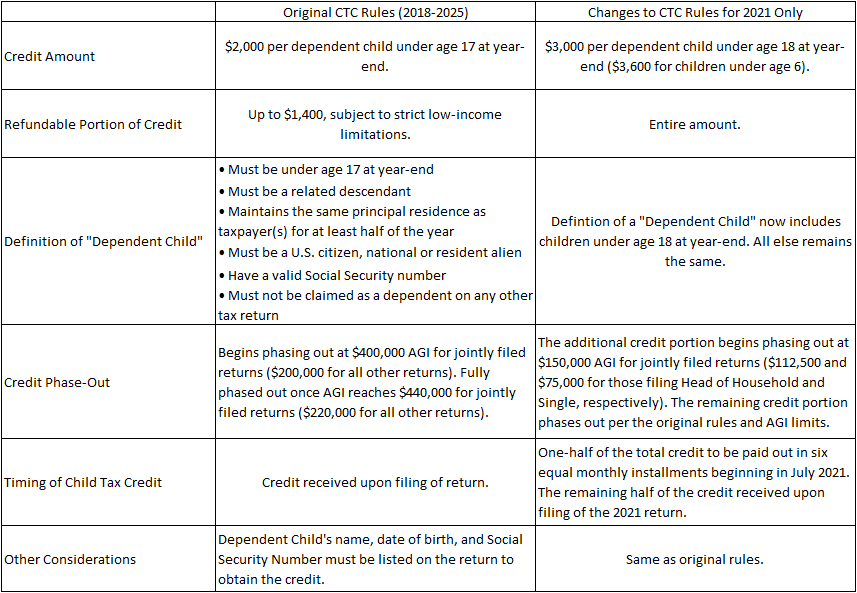

The IRS and Department of Treasury announced that the expanded credit will begin being paid out as advanced monthly payments starting July 15 to. Families will receive a maximum of 3600 for each child under 6 for tax year 2021 and a maximum of 3000 for kids 6 through 17. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Invalid Date JOE Biden is calling for expanded child tax credit payments to be extended until 2025 - as millions of families are set to receive their first payments next week. 15 opt out by Aug.

13 opt out by Aug. Change language content. The legislation made the existing 2000.

The Child Tax Credit was significantly expanded in 2021 by the American Rescue Plan so families could receive up to 3600 per child under 6 and 3000 for those ages 6 to 17. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Heres an overview of what to know.

Under the current plan the child tax credit will financially assist eligible parents through the end of this year. The American Rescue Plan expanded the child tax credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17. The agency says most eligible families do not.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/ZC2UJNBJU5DO4L6JMBC5H3YHB4.jpg)

Usa Finance And Payments Live Updates Gas Stimulus Check Tax Deadline Child Tax Credit Tax Refunds As Usa

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Four Reasons The Expanded Child Tax Credit Should Be Permanent Rwjf

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

About The 2021 Expanded Child Tax Credit Payment Program

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

White House And Senate Democrats Eye Child Tax Credit Hail Mary

Arizona Families Now Getting Monthly Child Tax Credit Payments

Biden Touts Expanded Child Tax Credit Abc News

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

What The Expanded Child Tax Credit Means To Families Localmemphis Com

![]()

Kansas City Families Brace For The End Of Expanded Federal Child Tax Credits Kcur 89 3 Npr In Kansas City

Today S Enhanced Monthly Child Tax Credit Payment Could Be The Last That Families Receive Unless Congress Acts To Extend This Successful Policy The Pulse

Here S Who Will Benefit From The Expanded Child Tax Credit Marketplace

Child Tax Credit Extension 2022 What Would Democrats Proposal Change Marca

Extend The Child Tax Credit For The Sake Of The Economy And Working Families Editorial

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors