b&o tax form

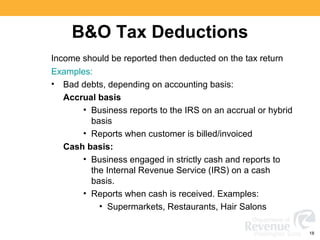

The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Wahler joins Biden Harris in discussion with mayors.

Tax Everett Form Fill Online Printable Fillable Blank Pdffiller

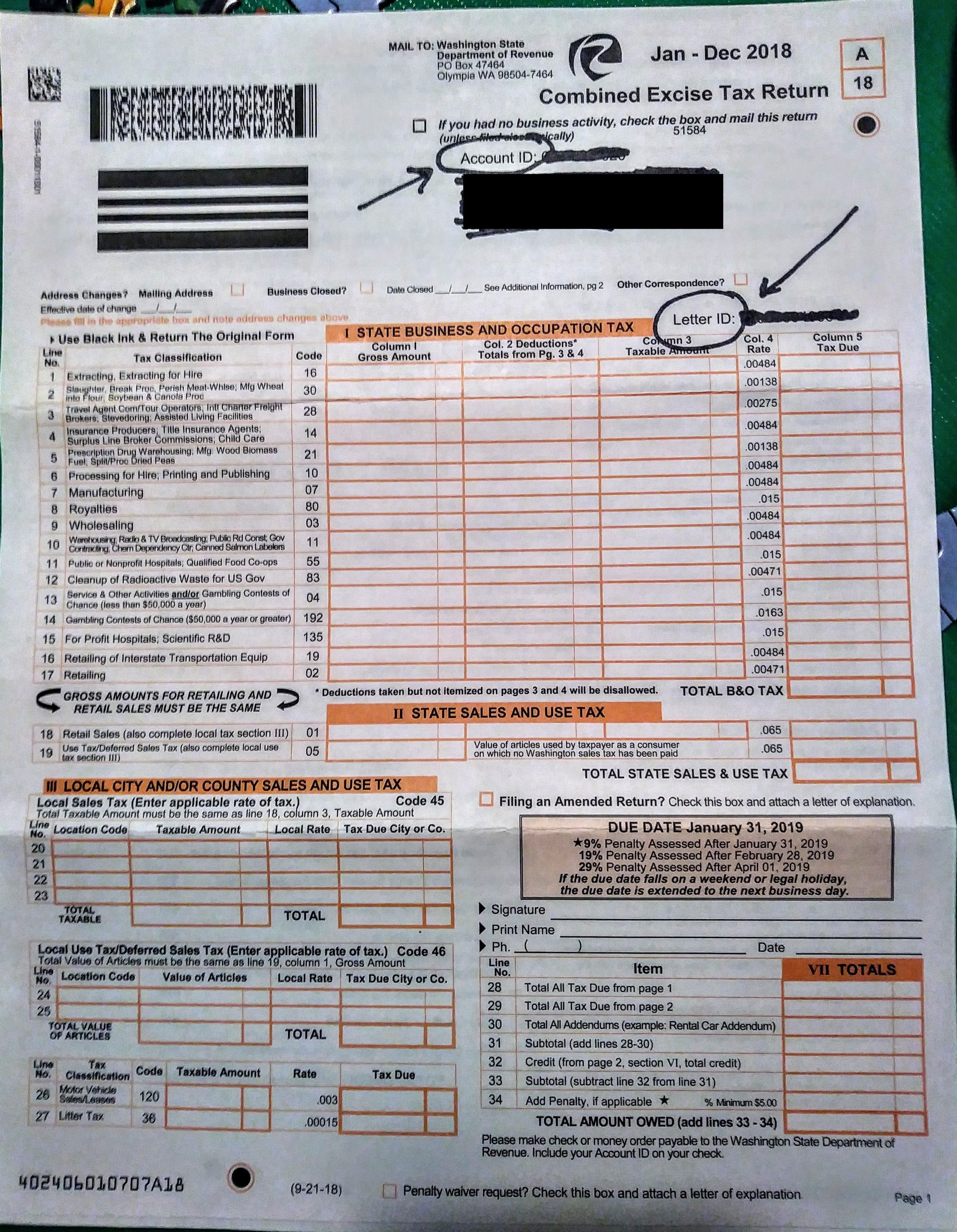

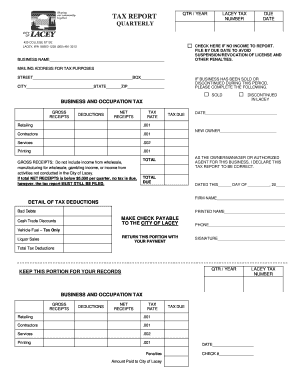

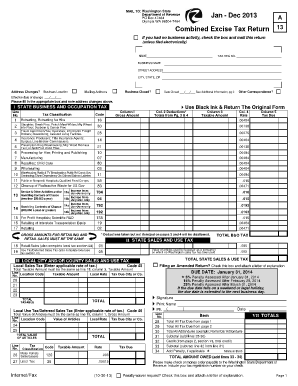

Sign the form and mail in a check payment for the total taxes due by the Quarterly due date.

. All taxes administered by Bellevue including the Business Occupation Tax and miscellaneous taxes such as utility admission and gambling taxes are reported on the. 225 215-0052 or 1-877-693-4435 or email. Rental Property Registration Form.

Piscataway Mourns the Loss of Favorite Son Kenny Armwood. Download the B O Tax form below. Please file your City BO taxes on the FileLocal portal.

29 of the tax due if not received on or before the last day of the second month following the due date. 800AM - 430PM M-F. Minimum penalty on all late returns where tax is due is 500.

To submit your B O Tax Form follow these instructions. Depending on your situation filing your Seattle taxes may be relatively simple or fairly. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787.

In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO. BO Tax Return Form. B.

It is measured on the value of products gross proceeds of sale or gross income of the business. PENALTIES Please provide the following information if there has. 455 Hoes Lane Piscataway NJ 08854 Phone.

The Citys General Fund provides for most day-to-day city services such as police services parks and. Washington unlike many other states does. City Hall Main Phone 304 722-3391.

Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft. BO Tax Return Annual - Quarterly. Businesses choose which way to submit Tax returns.

If this Tax Return is past due the following penalties must be included in your payment - minimum penalty 500 if tax is due. The state BO tax is a gross receipts tax. Monday April 26 2021.

If you would like assistance navigating the FileLocal system please call FileLocal directly at. City Hall Address 1499 MacCorkle Avenue St. There is no penalty on late.

Lower municipal tax rate for four years in a row. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. The City collects revenues in the form of taxes to provide services to the community.

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

City Of Lacey B O Tax Form Fill Out And Sign Printable Pdf Template Signnow

B Amp O Tax Return City Of Bellevue

2018 Tips For Marketplace Sellers Filing Your Washington Sales Tax Return Taxjar Support

Combined Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

Business Occupation Tax Bainbridge Island Wa Official Website

Tax Exempts And Washington S Business And Occupation Tax

Business Occupation Tax Bainbridge Island Wa Official Website

What Types Of Taxes Must I File As A Washington Based Therapist

Treasury Business Occupation Tax Bluefield West Virginia

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Business Occupation Tax Bainbridge Island Wa Official Website

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Taxjar Autofilers How To File Washington Business And Occupation Tax Taxjar

Business And Occupation Tax City Of Renton

Tax Everett Form Fill Online Printable Fillable Blank Pdffiller

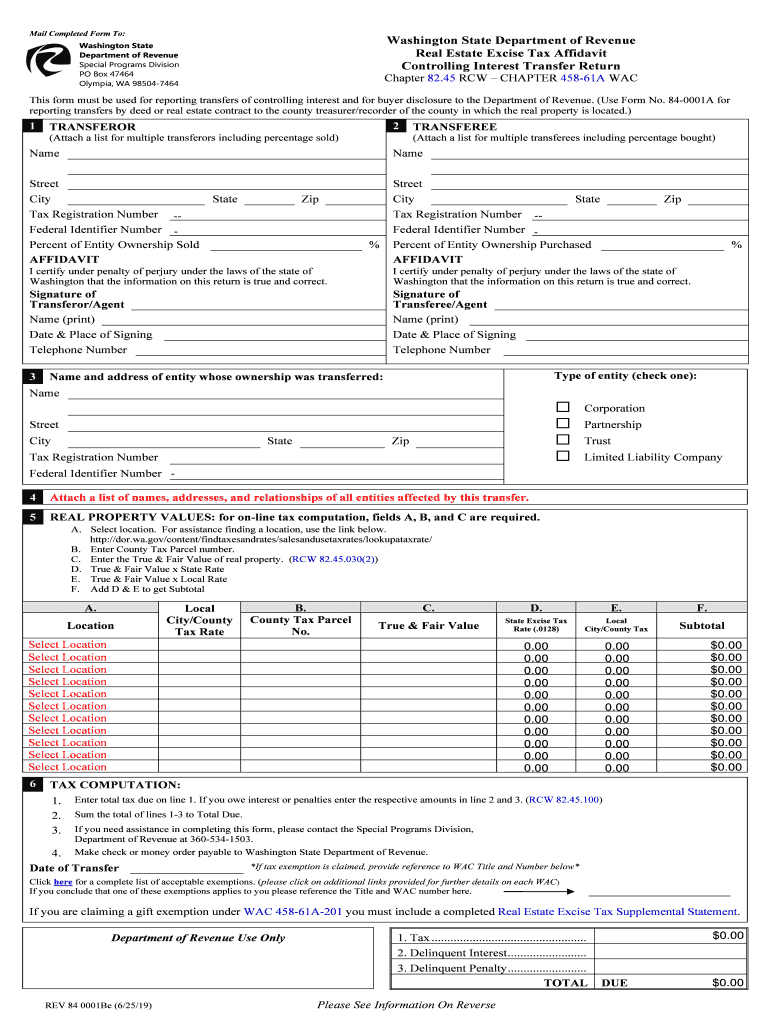

Wa Dor 84 0001b 2019 2022 Fill Out Tax Template Online Us Legal Forms

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women